- Home

- About Journals

-

Information for Authors/ReviewersEditorial Policies

Publication Fee

Publication Cycle - Process Flowchart

Online Manuscript Submission and Tracking System

Publishing Ethics and Rectitude

Authorship

Author Benefits

Reviewer Guidelines

Guest Editor Guidelines

Peer Review Workflow

Quick Track Option

Copyediting Services

Bentham Open Membership

Bentham Open Advisory Board

Archiving Policies

Fabricating and Stating False Information

Post Publication Discussions and Corrections

Editorial Management

Advertise With Us

Funding Agencies

Rate List

Kudos

General FAQs

Special Fee Waivers and Discounts

- Contact

- Help

- About Us

- Search

Open Urban Studies and Demography Journal

(Discontinued)

ISSN: 2352-6319 ― Volume 4, 2018

Automotive FDI and Dependent Development: The Case of Slovakia’s City-Regions in the Bratislava-Zilina Corridor

A.J. Jacobs*

Abstract

Since the fall of State Socialism in 1989, the world’s largest automakers have established 13 light vehicle assembly plants in the Central European nations of Czechia, Hungary, Poland, and Slovakia. Although it missed much of the 1990s boom, the central location of Slovakia’s city-regions, along with their skilled, but relatively inexpensive labor force, have resulted in that nation becoming a prime production base for the export of automobiles to developed Europe during the 2010s, as well as to North America.

Drawing upon World Systems Theory and research on the CE auto industry, this article examines Automotive Industry related foreign direct investment (i.e., Auto FDI) in Slovakia’s Bratislava, Trencin, Trnava, and Zilina City-Regions (i.e. the Bratislava-Zilina Corridor). It finds that although Auto FDI may have helped boost Slovakia’s Gross Domestic Product and per capita Gross National Income to semi-periphery levels, it also has made the economies of the four city-regions in its Bratislava-Zilina Corridor overly dependent on foreign transnational corporations from the highly cyclical automotive industry. Basing its conclusions upon World System theorist depictions of semi-periphery nations, it then concludes that while Slovakia’s economic levels may qualify as middle income/semi-periphery, the structural role its major city-regions play within the world’s automotive industrial division of labor has not yet achieved this position. Rather, their status now more closely resembles what might be labeled the upper perimeter of the periphery, where core-peripheral-like power relations have remained much more prominent than in many other semi-periphery nations, particularly as compared with the original Asian NIEs and today’s BRICs.

Article Information

Identifiers and Pagination:

Year: 2016Volume: 2

First Page: 1

Last Page: 19

Publisher Id: OUSDJ-2-1

DOI: 10.2174/2352631901602010001

Article History:

Received Date: 28/9/2015Revision Received Date: 16/1/2016

Acceptance Date: 18/2/2016

Electronic publication date: 30/06/2016

Collection year: 2016

open-access license: This is an open access article licensed under the terms of the Creative Commons Attribution-Non-Commercial 4.0 International Public License (CC BY-NC 4.0) (https://creativecommons.org/licenses/by-nc/4.0/legalcode), which permits unrestricted, non-commercial use, distribution and reproduction in any medium, provided the work is properly cited.

* Address correspondence to this author at the Department of Sociology 405A Brewster, East Carolina University, MS 567, Greenville, NC 27858, USA; Tel: 252-328-1933; E-mails: jacobsa@ecu.edu, drajjacobs@yahoo.com

| Open Peer Review Details | |||

|---|---|---|---|

| Manuscript submitted on 28-9-2015 |

Original Manuscript | Automotive FDI and Dependent Development: The Case of Slovakia’s City-Regions in the Bratislava-Zilina Corridor | |

INTRODUCTION

Since the fall of State Socialism, eight of the world’s 12 largest automakers have established light vehicle assembly plants in Central Europe’s (CE) Visegrad Four Nations (V4) nations: the Czech Republic (Czechia), Hungary, Poland, and Slovakia. This process began in earnest in the early 1990s, with the major foreign direct investments (FDI) of Fiat in Poland, Suzuki in Hungary, and Volkswagen in Czechia. The success of these initial factories then attracted numerous foreign auto suppliers to these areas, and later, more assembly plants.

Although it missed much of the 1990s boom, the central location of Slovakia’s city-regions, along with their skilled, but relatively inexpensive labor force, have resulted in that nation becoming a prime production base for the export of automobiles to developed Europe during the 2010s, as well as to North America. Through brief review of automotive production related development in the Bratislava, Trencin, Trnava, and Zilina City-Regions (heretofore, the city-regions in the Bratislava-Zilina Corridor), and drawing upon World Systems Theory and research on the CE auto industry, this article examines whether or not Automotive Industry related foreign direct investment (i.e., Auto FDI) also has served to advance Slovakia’s structural position in the globe’s industrial division of labor from periphery to semi-periphery.

Following a comparison of its automotive industrial economy with that of Wallerstein’s [1Wallerstein I. Concepts for comparative analysis. Comp Stud Soc Hist 1974; 16(4): 387-415.

[http://dx.doi.org/10.1017/S0010417500007520] , 2Wallerstein I. Modern world-system I-III. New York: Academic Press 1974-1989.] and Chase-Dunn & Hall’s [3Chase-Dunn C, Hall T. Rise and demise: Comparing world Systems. Boulder: Westview Press 1997.] five types of semi-periphery nations, it finds that Slovakia’s position in the global automotive industry’s division of labor qualifies as a semi-periphery nation under only one of their typology’s categorizations - its fortuitous geographic location in the CE. This analysis also suggests that although auto FDI has transformed the city-regions in the Bratislava-Zilina Corridor into important loci for car production, it also has made the economies of its city-regions,, overly dependent upon core-based, foreign transnational corporations (TNCs) in the highly cyclical motor vehicle industry.

Based upon this, the article concludes that despite Slovakia’s Gross Domestic Product (GDP), Gross National Income (GNI), and GDP and GNI per capita qualifying it as a semi-peripheral nation, the structural position its major city-regions now play within in the world automotive division of labor has not yet risen to this status [4According to spreadsheet data downloaded from the World Bank’s website, Slovakia had a GDP in current US dollars of $97.71 billion in 2013 (€70.97 billion) and a GNI in current US dollars of $95.77 billion (€69.567 billion). This gave it a GDP per capita in current US Dollars of $18,050 (€13,110), a GNI per capita of $17,810 (€12,936) and GNI at Purchasing Power Parity (PPP) of in current international dollars of $25,970 (€18,863) in current Euros. [Retrieved on July 23, 2015]. Available from: http://data.worldbank.org/indicator?display=default Currency rates to Euro were obtained from Oanada.com for December 31, 2013]. Rather, the role its major city-regions play, at least within the world motor vehicle production chain, now more closely resembles what may be labeled the upper perimeter of the periphery. In other words, they have achieved a position situated at the upper boundary of the periphery, approaching semi-periphery, but where peripheral-like economic relations have remained much more prominent than in most scholarly descriptions of semi-periphery nations, particularly the original Asian NIEs and today’s BRICs (Brazil, Russia, India, and China [5Arrighi G, Drangel J. The stratification of the world economy: An exploration of the semiperiperhal zone. Review 1986; 10(1): 9-74. [Fern Braud Ctr].].

In the next section, the article will review some of the major theoretical perspectives examining core-semi-periphery-periphery relations. This will include a separate section focusing on recent literature analyzing auto industry production in the CE. It then will chronicle the post-1990s rise of motor vehicle manufacturing in Slovakia’s four largest city-regions, followed by the aforementioned section analyzing the area’s structural position in the world motor vehicle production chain.

World Systems and Current Theories of Auto Production Related Dependency in the CE

Core, Semi-Periphery, Periphery, and their Perimeters

Numerous theories have examined dominance-dependency relationships between transnational corporations (TNC) headquartered in the wealthiest, most developed ‘core’ countries and regions/workers situated in less affluent, developing, ‘periphery’ nations. One of the earlier important works on the topic was Roderick McKenzie’s [6McKenzie R. The concept of dominance and world organization. Am J Sociol 1927; 33(1): 18-42.

[http://dx.doi.org/10.1086/214331] ] seminal article, ‘The Concept of Dominance and World Organization.’ Later, Hans Singer and Raul Prebisch, Paul Baran, Andre Gunder Frank, Stephen Hymer, Samir Amin, Richard Barnet and Ronald Muller, Fernando Cardoso, R. B. Cohen, Peter Evans, and others provided critical and astute commentaries on the situation. However, perhaps the most influential post-war theoretical paradigm analyzing core-periphery relations was ‘World Systems Theory.’ Although frequently critiqued and not quite as popular as in the 1980s and 1990s, Immanuel Wallerstein’s conceptual framework remains illuminating when examining the world motor vehicle production chain.

As detailed countless times before, Wallerstein [1Wallerstein I. Concepts for comparative analysis. Comp Stud Soc Hist 1974; 16(4): 387-415.

[http://dx.doi.org/10.1017/S0010417500007520] , 2Wallerstein I. Modern world-system I-III. New York: Academic Press 1974-1989., 7Wallerstein I. The capitalist world-economy: Essays by Immanuel Wallerstein. New York: Cambridge University Press 1979., 8Wallerstein I. Modern world-system I-IV: Centrist liberalism triumphant, 1789-1914. Berkeley: University of California Press 2011.] chronicled how, since the rise of modern capitalism in the 16th Century, the world’s territorial units have evolved into a stratified, three-tiered, political-economic system. At the top of this hierarchy stood the most industrialized core countries, which established and maintained their hegemonic power by expanding their production markets into, and extracting surplus value from, the less developed/industrializing semi-periphery and the underdeveloped periphery economies. In other words, for Wallerstein, core, semi-periphery, and periphery represented the three distinct structural positions within the world capitalist system’s international division of labor.

This was not to suggest, however, that Wallerstein believed that all countries within a given structural position were the same economically and/or politically (for example, North Korea and Bolivia were both periphery nations). Nor did he feel that the current status level of any given nation was static, but rather could, in fact, fluctuate over time. For example, he claimed that if a semi-periphery nation strengthened its political, economic and industrial infrastructure, and achieved the right balance of wage levels, labor organization, purchasing power, technology, and competitiveness, it was possible for it to figuratively, ascend to the core. Nevertheless, while Wallerstein contended that it was possible for nations to advance within the world capitalist hierarchy, he also claimed that the core constantly attempted to maintain its exclusive superiority by utilizing redistributive policies (such as plant relocation, overseas aid, and raw materials extracting) to purposefully divide non-core nations into competing subgroups. As a result, the economies of the semi-periphery were frequently furthered by the core, and thereafter, the former was utilized as middlemen to reinforce core hegemony, to prevent alliances between semi-periphery and periphery nations, and to further exploit the periphery.

Since the initial publication of Wallerstein’s typology during the early 1970s, World Systems Theory has been augmented by the works of such prominent scholars as Christopher Chase-Dunn [9Chase-Dunn C, Ed. Socialist states in the world system. Beverly Hills: Sage 1982.-11Chase-Dunn C. Global formation: Structures of the world economy. Lanham, MD: Rowman & Littlefield Publishers 1998.], Giovanni Arrighi [5Arrighi G, Drangel J. The stratification of the world economy: An exploration of the semiperiperhal zone. Review 1986; 10(1): 9-74. [Fern Braud Ctr]., 12Arrighi G, Ed. Semiperipheral development: The politics of southern europe in the twentieth century. Beverly Hills: Sage Publications 1985., 13Arrighi G. The long twentieth century: Money, power, and the origins of our times. New York: Verso 2010.], and Michael Timberlake [14Timberlake M. World system theory and the study of comparative urbanization. In: Smith M, Feagin J, Eds. The capitalist city. Cambridge, MA: Basil Blackwell 1987; pp. 37-65.], among others. Later in this article, Chase-Dunn and Arrighi’s discussions on semi-periphery nations will provide important insight into the context for auto production development in the Bratislava-Zilina Corridor. Most relevant to this analysis are Chase-Dunn & Thomas Hall’s [3Chase-Dunn C, Hall T. Rise and demise: Comparing world Systems. Boulder: Westview Press 1997.] criteria for classifying an economy as a semi-periphery nation, and Arrighi’s article with Jessica Drangel which expanded Wallerstein’s triad to five-tiers, including the interim positions of ‘perimeter of the core’ and ‘perimeter of the periphery’ [5Arrighi G, Drangel J. The stratification of the world economy: An exploration of the semiperiperhal zone. Review 1986; 10(1): 9-74. [Fern Braud Ctr].].

Theories Focusing on the Auto Industry and Dependency Relations in the CE

Over the past decade, research on the dramatic expansion of motor vehicle production in the post-Socialist Central European (CE) and its resulting TNC-State/region machinations has made an important topic to the literature on core-semi-periphery-periphery relations. The highlight of this was the special issue in European Urban and Regional Studies edited by Boleslaw Domanski & Yannick Lung [15Domanski B, Lung Y. The changing face of the European periphery in the automotive industry. Eur Urban Reg Stud 2009; 16(1): 5-10.

[http://dx.doi.org/10.1177/0969776408098928] ]. These two authors, along with Petr Pavlinek and Adrian Smith, have been at the forefront of such analyses of the CE. While Domanski has focused upon auto FDI in Poland, Lung [16Lung Y. The changing geography of the European automobile system. Int J Auto Tech Man 2004; 3(2-3): 137-65., 17Carrillo J, Lung Y, Van Tulder R, Eds. Cars, carriers of regionalism?. Basingstoke: Palgrave Macmillan 2004.

[http://dx.doi.org/10.1057/9780230523852] ] has studied various areas in what he calls the European periphery, including detailing the spatial restructuring of production among core and periphery Mediterranean nations. Meanwhile, Pavlinek who has written extensively on auto FDI in Czechia, also has covered the issue in Slovakia, Poland, and Hungary. Smith, on the other hand, has offered a broader examination of the post-Socialist industrial transformation in Slovakia.

According to Domanski & Lung [15Domanski B, Lung Y. The changing face of the European periphery in the automotive industry. Eur Urban Reg Stud 2009; 16(1): 5-10.

[http://dx.doi.org/10.1177/0969776408098928] ], the shift in motor vehicle production from Western Europe to the CE was fueled by a combination of foreign direct acquisitions of local firms, joint-ventures, and increasingly, new plant construction. They explained that initially, large foreign automakers were attracted to the European periphery by the possibility of rapid sales in emerging post-Socialist Europe and by the potential low-cost sourcing options for exporting components to Western Europe [16Lung Y. The changing geography of the European automobile system. Int J Auto Tech Man 2004; 3(2-3): 137-65., 18Humphrey J, Lecler Y, Salerno M, Eds. Global strategies and local realities: The auto industry in an emerging market. New York: Macmillan Press 2000.

[http://dx.doi.org/10.1057/9780333977712] ]. However, this ’Go East’ strategy, they argued, was “driven by more than [just] wage-cost advantages and market access. Quality, reliability, and proximity provided further important conditions conducive to investment and production growth” [15Domanski B, Lung Y. The changing face of the European periphery in the automotive industry. Eur Urban Reg Stud 2009; 16(1): 5-10.

[http://dx.doi.org/10.1177/0969776408098928] ]. Furthermore, they claimed that the centrally located, ‘integrated periphery markets’ of the V4 nations of Czechia, Slovakia, Hungary, and Poland, best represented these characteristics [18Humphrey J, Lecler Y, Salerno M, Eds. Global strategies and local realities: The auto industry in an emerging market. New York: Macmillan Press 2000.

[http://dx.doi.org/10.1057/9780333977712] , 19Pavlinek P, Domanski B, Guzik R. Industrial upgrading through foreign direct investment in central European automotive manufacturing. Eur Urban Reg Stud 2009; 16(1): 43-63.

[http://dx.doi.org/10.1177/0969776408098932] ]. They stated that later, the former Yugoslav republics of Slovenia and Serbia, along with Romania and Turkey, would provide competitive alternatives to the V4 [17Carrillo J, Lung Y, Van Tulder R, Eds. Cars, carriers of regionalism?. Basingstoke: Palgrave Macmillan 2004.

[http://dx.doi.org/10.1057/9780230523852] ].

In his own work, Domanski has detailed how core auto FDI has fueled the creation of a sizable multinational supplier base in Poland, with nine out of the world’s ten largest automotive components manufacturers located in the country, including Delphi, Lear, and TRW of the USA, and Valeo and Faurecia of France. In addition, Fiat (Italy), General Motors (USA), Toyota (Japan), and Volkswagen (Germany) had engine plants there [20ACEA. Automobile assembly & engine production plants in Europe: By country. Brussels: European Automobile Manufacturers’ Association 2015. [Retrieved July 23, 2015]. Available from: http://www.acea.be/statistics/tag/category/european-production-plants-map ]. As a result, Domanski claimed that auto FDI has helped push Poland, as well as Czechia and Slovakia, to semi-periphery status in the world economy [21Domanski B, Guzik R, Gwodz K. The new international division of labor and the changing role of the periphery: The case of the Polish automotive industry. In: Tamasy C, Taylor M, Eds. Globalising worlds and new economic configurations. Aldershot: Ashgate 2008; pp. 85-99.-23Domanski B, Guzik R, Gwodz K, Dej M. The crisis and beyond: The dynamics and restructuring of automobile industry in Poland. Int J Auto Tech Man 2013; 13(2): 151-66.]. Based upon their case studies of Germany and Poland, and interviews in Czechia and Ukraine, Jurgens and Krzywdzinski [24Jurgens U, Krzywdzinski M. Changing East-West division of labour in the European automotive industry. Eur Urban Reg Stud 2009; 16(1): 27-42. a

[http://dx.doi.org/10.1177/0969776408098931] , 25Jurgens U, Krzywdzinski M. Work models in the central Eastern European car industry: Towards the high road? Int Rel J 2009; 40(6): 471-90. b] supported Domanski’s assertions. They concluded that “the overall effect of the expansion of the automotive industry on growth and employment in the CE was positive” [25Jurgens U, Krzywdzinski M. Work models in the central Eastern European car industry: Towards the high road? Int Rel J 2009; 40(6): 471-90. b].

In contrast to these positive assertions, Petr Pavlinek, Eric Rugraff, and Adrian Smith and Adam Swain have claimed that since CE nations have become so over-dependent upon foreign capital, especially motor vehicle related FDI, that they have not, as of yet, ascended to a semi-periphery position, at least in the European automotive production chain [19Pavlinek P, Domanski B, Guzik R. Industrial upgrading through foreign direct investment in central European automotive manufacturing. Eur Urban Reg Stud 2009; 16(1): 43-63.

[http://dx.doi.org/10.1177/0969776408098932] , 26Pavlinek P. Restructuring of the Polish passenger car industry through foreign direct investment. Eura Geog and Econ 2006; 47(3): 353-77.

[http://dx.doi.org/10.2747/1538-7216.47.3.353] -36Rugraff E. Foreign direct investment (FDI) and supplier-oriented upgrading in the Czech motor vehicle industry. Reg Stud 2010; 44(5): 627-38.

[http://dx.doi.org/10.1080/00343400903095253] ]. This has been especially the case for Slovakia [37Jakubiak M, Kolesar P, Izvorski I, Kurekova L. The automotive industry in the Slovak Republic. Washington, DC: International Bank for Reconstruction and Development/World Bank, Commission on Growth and Development 2008. Working Paper No, 29].

According to these scholars, and echoing Evans’ [38Evans P. Class, state and dependence in East Asia: Lessons for Latin Americanists. In: Deyo F, Ed. The political economy of the new Asian industrialism. Ithaca, NY: Cornell University Press 1987; pp. 203-26.] warnings to Latin American nations, one of the prime reasons why CE nations have remained marginalized has been their lack of native-owned original equipment manufacturers (OEM). In fact, in three of the four nations, the central government privatized and then sold their state-owned vehicle producers to foreign TNCs: Fiat gained control of Fabryka Samochodow Małolitrazowych (FSM) in Poland; and VW acquired Skoda’s of Czechia and its former branch plant in Slovakia, Bratislavske Automobilove Zavody (BAZ) [39Fiat has been active in the Polish car industry since 1920. In addition, both the state-run Fabryka Samochodow Osobowych (FSO) “and FSM were built and operated based upon license agreements concluded with Fiat during the socialist period… Fiat purchased a 90 percent stake in a joint venture with FSM for $261 million (€197 million) on September 17, 1993,” see Pavlinek [29], p. 356. Conversion rates for this article were obtained from Oanda.com ]. Moreover, as Pavlinek pointed out:

Despite the increasing role of the CE in…passenger car assembly, [its] position …in the European automotive … division of labor continues to be disproportionately weak…Strategic functions, including R&D, have remained highly concentrated in the West European core, especially in Germany, without any signs of diminishing … [and] the degree of concentration in the core [was] increasing during the 2000s [28Pavlinek P. The internationalization of corporate R&D and the automotive industry R&D of East-Central Europe. Econ Geogr 2012; 88(3): 279-310.

[http://dx.doi.org/10.1111/j.1944-8287.2012.01155.x] ].

He concluded that:

This situation underscores the peripheral nature of the CE… in the European automotive production system after 1990. While the standardized vehicle assembly and the production of components have dispersed to the CE periphery mainly to exploit lower production costs and more flexible labor practices, the whole system [remains] controlled from the core through the direct ownership of all CE-based assemblers and most component suppliers by core-based TNCs [28Pavlinek P. The internationalization of corporate R&D and the automotive industry R&D of East-Central Europe. Econ Geogr 2012; 88(3): 279-310.

[http://dx.doi.org/10.1111/j.1944-8287.2012.01155.x] ].

So which perspective best represents the current situation in the Bratislava-Zilina Corridor? Has auto FDI helped propel Slovakia to a semi-periphery position in the world motor vehicle production chain? Or have developments merely been emblematic of traditional core-periphery relations? After providing a brief history of light vehicle manufacturing in the Bratislava-Zilina Corridor, this article addresses these questions. Drawing upon World Systems Theory, Pavlinek, Evans, and others, it then suggests that while auto FDI has helped to increase post-socialist Slovakia’s socio-economic indicators to levels similar to that of middle income nations, the nation’s structural position in the world’s automotive industry’s division of labor has not yet reached to semi-periphery status. Rather, in terms of the auto industry, Slovakia has achieved a status which befits what might be called the upper perimeter of the periphery, where core-peripheral-like economic relations have remained much more prominent than in many other semi-periphery nations, particularly, the original Asian NIEs and BRICs.

The Initial Development of the Bratislava-Zilina Auto Corridor

Following World War II, the Soviet bureaucracy pegged Czechoslovakia and East Germany as the primary bases for light vehicle production in the CE. Hungary was selected as the site for bus manufacturing [27Pavlinek P. A successful transformation? Restructuring of the Czech automobile industry. Omaha: Physica-Verlag 2008., 40Myant M. The Czechoslovak economy, 1948-1988. New York: Cambridge University Press 1989., 41Pavlinek P. Restructuring the Central and Eastern European automobile industry: Legacies, trends, and effects of foreign direct investment. Post Sov Geogr Econ 2002; 43(1): 41-77.]. In Czechoslovakia, the motor vehicle industry was nationalized, and Skoda, founded in 1895 in the town of Mlada Boleslav, north of Prague, was authorized as the sole-producer of small, inexpensive passenger cars in the region. Meanwhile, Tatra, which began making vehicles in 1850 in the present-day eastern Czech town of Koprivnice, was assigned the task of building large luxury cars [27Pavlinek P. A successful transformation? Restructuring of the Czech automobile industry. Omaha: Physica-Verlag 2008., 40Myant M. The Czechoslovak economy, 1948-1988. New York: Cambridge University Press 1989.]. “This directive meant, for example,” that Jawa Motors of Prague was ordered to cease its small car production and to concentrate only on motorcycles [27Pavlinek P. A successful transformation? Restructuring of the Czech automobile industry. Omaha: Physica-Verlag 2008.]. In addition, Skoda truck production was allocated to three Prague-based firms, Aero, Avia, and Praga.

In the 1950s, as the Czechoslovakian Government was instructed to focus more heavily upon the defense industry, the nation’s light vehicles production was reorganized. During this period, Tatra’s passenger car production was shifted to Skoda’s Mlada Boleslav plant and the former was directed to build military trucks and heavy-duty defense vehicles. Additionally, Jawa’s motorcycle and moped production was transplanted from Prague to the Povazska Bystrica District of present-day Slovakia’s Trencin Region; this district would later become home to foreign firms manufacturing tires, glass, cable assemblies, plastics, and metal components for automobiles [42SARIO. Regional analyses, 2007-2014. Slovak Investment and Trade Development Agency 2008-2015. Annually revised e-documents on the automotive sector published between 2007 and 2015. [Retrieved July 21, 2015]. Available from: http://www.sario.sk/?regional-analysis ].

During the 1960s and 1970s, the State invested more heavily in vehicle production, modernizing and expanding Skoda’s operations through the construction of several new factories. In response to pressure from Slovak politicians, this included a decision in 1971 to build a Skoda branch plant in Bratislava, which would become known as BAZ. Officially launched in the Bratislava Borough of Devínska Nova Ves on April 3, 1974, BAZ began by assembling Skoda 731 model sedans, 732 station wagons, and BAZ-brand light trucks, from parts manufactured in Czech plants [30Pavlinek P. Whose success? The state–foreign capital nexus and the development of the automotive industry in Slovakia. Euro Urb and Reg Stud 2015; 22, forthcoming. First published online in December 10, 2014.

[http://dx.doi.org/10.1177/0969776414557965] ].

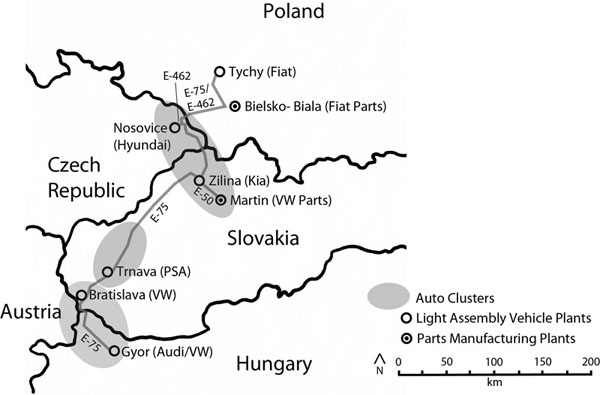

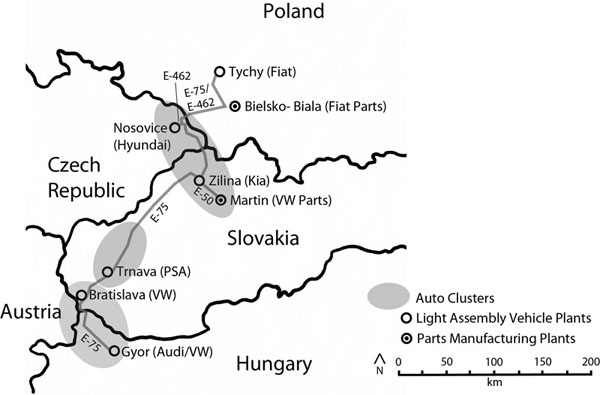

Also during the 1970s, output of light commercial vehicles was shifted from Vrchlabi (Czechia) to Slovakia’s Trnava Region, and tractor engine production commenced in the Zilina Region’s defense-industry city of Martin [27Pavlinek P. A successful transformation? Restructuring of the Czech automobile industry. Omaha: Physica-Verlag 2008., 43Smith A. Reconstructing the regional economy: Industrial transformation and regional development in Slovakia. Cheltenham, UK: Edward Elgar 1998.]. Thereafter, large agricultural tractor manufacturing was shifted from Brno in Czechia to Martin. At the time, Martin was dominated by the large armaments firm ZTS TEES, whose “production profile [included] “Soviet-licensed T-model tanks, locomotives, locomotive engines, railway wagons, diesel motors…. and iron and steel” [43Smith A. Reconstructing the regional economy: Industrial transformation and regional development in Slovakia. Cheltenham, UK: Edward Elgar 1998.]. Although these State-owned endeavors would never manufacture more than a few thousand Skoda cars annually under Socialism, the city-regions in the Bratislava-Zilina Corridor (Bratislava, Trnava, Trencin, and Zilina) would later become the core nodes of FDI in the Slovak auto industry; Nitra (automotive parts) and Kosice (steel) also would become complimentary nodes (again see Fig. 1 ).

).

|

Fig. (1) The bratislava, trnava, and zilina city-regions in slovakia. |

Whereas the 1970s was a period of growth, the 1980s was marked by insufficient and misguided State investment. As a result, the technology, reliability, and fit and finish quality of Skoda’s small, inexpensive models lagged far behind Western automobiles. In 1989, this left the company highly vulnerable to foreign takeover, when the Iron Curtain fell and the Czechoslovakian economy was opened to market capitalism. Thereafter, in an effort to save its debt-ridden domestic car industry, the central government sought out foreign capital to partner with Skoda. On December 9, 1990, it found its savior, selecting VW over 23 other suitors, and selling the German automaker a 31 percent stake in Skoda’s Czechia-based operations for €315 million ($416 million) [44VW acquired 51% of the SEAT in June 1986, and, by the end of that year had increased its share to 75%, and thereby, took control of the Spanish automaker. See SEAT. SEAT company website: 60 years of SEAT history. [Retrieved September 21, 2013]. Available from: http://www.seat.com/content/com/com/en/company/history.html ]. Three months later, on March 12, 1991, VW again outbid five others for an 80 percent ownership share in BAZ, Skoda’s branch plant factory in Bratislava [27Pavlinek P. A successful transformation? Restructuring of the Czech automobile industry. Omaha: Physica-Verlag 2008., 37Jakubiak M, Kolesar P, Izvorski I, Kurekova L. The automotive industry in the Slovak Republic. Washington, DC: International Bank for Reconstruction and Development/World Bank, Commission on Growth and Development 2008. Working Paper No, 29, 44VW acquired 51% of the SEAT in June 1986, and, by the end of that year had increased its share to 75%, and thereby, took control of the Spanish automaker. See SEAT. SEAT company website: 60 years of SEAT history. [Retrieved September 21, 2013]. Available from: http://www.seat.com/content/com/com/en/company/history.html ].

As presented in Table 1, VW-BAZ assembled its first two VW Passat sedans at its completely re-tooled Bratislava plant in December 1991. Serial production commenced two months later in February 1992. Over the next two years, a paint shop and a gearbox assembly line was added, along with the manufacturing of VW’s popular Golf model and in 1994, VW bought out BAZ and took total control of the Bratislava operations; it secured 100 percent ownership in Czechia’s Skoda in May 2000 [45VW AG. Volkswagen Slovakia. Retrieved on various dates, [Retrieved June 15, 2015]. Available from: http://en.volkswagen.sk/en/Company/ plants.html ].

During the late 1990s and early 2000s, aided by €33 million ($44 million) in tax abatements from the government’s 1999 ‘Development of the Automotive Industry’ Initiative, VW continued to widen its Slovak footprint. This program also attracted numerous large foreign suppliers, such as Johnson Controls, Magna, Faurecia, Lear, SAS Automotive, and Brose, many of which located just north of VW Bratislava in the city’s Lozorno Industrial Park [37Jakubiak M, Kolesar P, Izvorski I, Kurekova L. The automotive industry in the Slovak Republic. Washington, DC: International Bank for Reconstruction and Development/World Bank, Commission on Growth and Development 2008. Working Paper No, 29].

Following the subsidies, VW expanded and retooled the Bratislava factory, resulting in a doubling in output to more than 200,000 vehicles by 2002. This included the launch of VW Polo subcompacts in January 2000 and the VW Touareg SUV in June 2002, with the latter date also commencing manufacture of Porsche Cayenne SUV bodies. These additions were followed by the introduction of the Audi Q7 luxury SUV in November 2005. VW also opened a large factory in May 2000 for the purpose of manufacturing gearboxes, chassis components, and other parts for its VW, Audi, Skoda, SEAT and Porsche brands, with 93 percent of the output being exported out of Slovakia [45VW AG. Volkswagen Slovakia. Retrieved on various dates, [Retrieved June 15, 2015]. Available from: http://en.volkswagen.sk/en/Company/ plants.html ].

In 2007, Polo production in Bratislava was halted and in March 2008 replaced by the larger Skoda Octavia model. The factory ceased output of the Octavia in 2010 as part of VW’s major retooling and expanding of the complex. Upon completion in late-2011, this approximately €302 million investment ($400 million) boosted plant capacity to 400,000 vehicles per year. In 2015, the factory employed 9,000 workers and produced 344,892 vehicles in 2013; output rose to 394,474 in 2014 [45VW AG. Volkswagen Slovakia. Retrieved on various dates, [Retrieved June 15, 2015]. Available from: http://en.volkswagen.sk/en/Company/ plants.html -47Volkswagen VW. Facts and figures, Navigator 2013. Wolfsburg: VW Group 2013.], (Table 1).

Twenty years after its opening, VW‘s Bratislava plant has remained Slovakia’s largest single FDI project. Including its Martin parts factory, the automaker employed 9,900 people nationwide [45VW AG. Volkswagen Slovakia. Retrieved on various dates, [Retrieved June 15, 2015]. Available from: http://en.volkswagen.sk/en/Company/ plants.html ]. In addition, in large part because of the Bratislava assembly plant, more than two-thirds of all FDI coming into Slovakia since 2002 has been allocated to the Bratislava Region; this proportion ranged between 55.9% and 62.5% from 1995 to 2001 [42SARIO. Regional analyses, 2007-2014. Slovak Investment and Trade Development Agency 2008-2015. Annually revised e-documents on the automotive sector published between 2007 and 2015. [Retrieved July 21, 2015]. Available from: http://www.sario.sk/?regional-analysis , 50Pavlinek P, Smith A. Internationalization and embeddedness in East-Central European transition: The contrasting geographies of inward investment in the Czech and Slovak Republics. Reg Stud 1998; 32(7): 619-38.

[http://dx.doi.org/10.1080/00343409850119517] ]. As will be discussed later, regions in northern Hungary and Eastern Czechia also have greatly benefitted from VW’s presence in the Bratislava-Zilina Corridor.

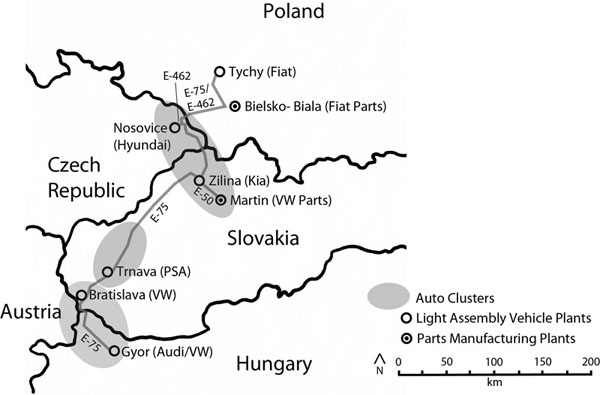

Not Just VW: The Bratislava-Zilina Auto Corridor

In total, VW has produced more than three million vehicles in Bratislava and more than four million gearboxes (transmissions) in Slovakia over the past 20 years [45VW AG. Volkswagen Slovakia. Retrieved on various dates, [Retrieved June 15, 2015]. Available from: http://en.volkswagen.sk/en/Company/ plants.html , 48OICA. World motor vehicle production by country and type: 1999-2014. Paris: International Organization of Motor Vehicle Manufacturers 1999-2015. Production and sales statistics for all years between 1999 and 2014. Retrieved on various dates, last July 23, 2015. Available from: http://oica.net VW’s output in 2013 would have been 426,313 and Slovakia’s total 988,882 if the Porsche Cayenne SUV bodies built in Bratislava were counted as light vehicles. SARIO [57] counted these in its total and report national production as 987,718 in 2013, see pp, 2, 4, 49SARIO. Automotive industry, 2010-2014. Slovak Investment and Trade Development Agency 2011-2015. Data obtained from this annually updated e-document, retrieved on various dates between 2010 and 2015, [Retrieved July 21, 2015]. Available from: http://www.sario.sk/sites/ default/files/content/files/Automotive%20Industry.pdf , 51Ward’s Communications. Ward’s automotive yearbook, 2014. Southfield, MI: Ward’s 2014., 52Ward’s Communications. Ward’s world’s vehicle data 2014. Southfield, MI: Ward’s 2014.]. However, in 2013, the German automaker was no longer the sole foreign car manufacturer with an assembly plant in Slovakia. After receiving a government incentive package of €170 million ($225 million) in January 2003 Peugeot-Citroen (PSA) of France agreed to build an assembly complex in Slovakia’s Trnava city, located approximately 44 miles (71 km) north of VW Bratislava (See Fig. 2 ). As shown again in Table 1, PSA’s factory, which launched production in October 2006, had an annual capacity of 300,000 vehicles. The plant employed 3,200 people in 2013, when it produced 248,411 mini hatchbacks and multi-purpose vehicles (MPV) [53PSA. PSA Peugeot Citroen annual reports, 2006-2012. Paris, 2007-2013. Annual reports downloaded on various dates, last October 1, 2013. Available from: http://www.psa-peugeot-citroen.com -55Kia Motors Slovakia. Kia motors company at a glance. Teplicka nad Vahom, Žilina, Slovakia 2015. [Retrieved July 15, 2015]. Available from: http://eng.kia.sk/ This included Kia Cee’d small hatchbacks (known as Kia Forte elsewhere), Kia Venga MPV (Kia Soul), and the twin compact SUV, the Kia Sportage/ Hyundai ix35 (Tucson in North America)].

). As shown again in Table 1, PSA’s factory, which launched production in October 2006, had an annual capacity of 300,000 vehicles. The plant employed 3,200 people in 2013, when it produced 248,411 mini hatchbacks and multi-purpose vehicles (MPV) [53PSA. PSA Peugeot Citroen annual reports, 2006-2012. Paris, 2007-2013. Annual reports downloaded on various dates, last October 1, 2013. Available from: http://www.psa-peugeot-citroen.com -55Kia Motors Slovakia. Kia motors company at a glance. Teplicka nad Vahom, Žilina, Slovakia 2015. [Retrieved July 15, 2015]. Available from: http://eng.kia.sk/ This included Kia Cee’d small hatchbacks (known as Kia Forte elsewhere), Kia Venga MPV (Kia Soul), and the twin compact SUV, the Kia Sportage/ Hyundai ix35 (Tucson in North America)].

|

Fig. (2) Slovakia’s city-regions in the bratislava-zilina auto corridor and nearby auto clusters. |

In March 2004, a year after PSA’s announcement, the South Korean automaker Kia, a division of Hyundai Motors, accepted approximately €982 million ($1.3 billion) in financial incentives, infrastructure, and housing subsidies, in order to construct a plant in the Village of Teplicka nad Vahom, in Slovakia’s Zilina Region, situated 100 miles northwest (160 km) of Trnava [37Jakubiak M, Kolesar P, Izvorski I, Kurekova L. The automotive industry in the Slovak Republic. Washington, DC: International Bank for Reconstruction and Development/World Bank, Commission on Growth and Development 2008. Working Paper No, 29], (Fig. 2 ). The facility, which built its first car in December 2006, had an annual capacity of 300,000 vehicles. Kia employed 3,800 workers at the factory in 2013, which manufactured 313,000 subcompact hatchbacks, MPV, and SUV in 2013 [56AmCham. Trnava: a strategic choice for connection: The automotive industry. Online Magazine of the American Chamber of Commerce in the Slovak Republic. May 24, 2011. [Retrieved September 28, 2013]. Available from: http://www.amcham.sk/publications/ connection-magazine/issues/3081_the-automotive-industry ], (Table 1).

). The facility, which built its first car in December 2006, had an annual capacity of 300,000 vehicles. Kia employed 3,800 workers at the factory in 2013, which manufactured 313,000 subcompact hatchbacks, MPV, and SUV in 2013 [56AmCham. Trnava: a strategic choice for connection: The automotive industry. Online Magazine of the American Chamber of Commerce in the Slovak Republic. May 24, 2011. [Retrieved September 28, 2013]. Available from: http://www.amcham.sk/publications/ connection-magazine/issues/3081_the-automotive-industry ], (Table 1).

In addition to the substantial incentive packages, both PSA and Kia both were attracted to the Bratislava-Zilina Corridor by its location, its transportation infrastructure, the presence of several large Tier-I multinational automotive components suppliers, and the area’s relatively educated, skilled (particularly in technical, mechanical and metalworking), inexpensive and non-adversarial labor force; for example, Kia’s facility was situated just 20 miles (32 km) west of VW Martin [63Pavlinek P. Transformation of the Central and East European passenger car industry: selective peripheral integration through foreign direct investment. Environ Plann A 2002; 34(9): 1685-709.

[http://dx.doi.org/10.1068/a34263] , 64SARIO. Why Slovakia. Slovak Investment and Trade Development Agency 2014. [Retrieved July 21, 2015]. Available from: http://www.sario.sk/?labor-market ]. These location decisions then prompted several of their own home nation Tier-I suppliers to also open plants in Slovakia.

As a result of VW, PSA, and Kia’s facilities, employment in motor vehicles and parts related manufacturing in Slovakia had expanded from less than 1,000 in 1990 to 22,000 in 1993 and then 81,682 in 2012 [49SARIO. Automotive industry, 2010-2014. Slovak Investment and Trade Development Agency 2011-2015. Data obtained from this annually updated e-document, retrieved on various dates between 2010 and 2015, [Retrieved July 21, 2015]. Available from: http://www.sario.sk/sites/ default/files/content/files/Automotive%20Industry.pdf , 57Jacobs, A. J. Auto FDI in emerging Europe: Shifting production locales in the world auto industry. London: Palgrave, forthcoming. Based upon the author’s: site visits and/or factory tours of VW Bratislava, VW Martin, PSA Trnava, Kia Zilina, and Audi Gyor; and correspondences with government officials, automakers, and scholarly experts in the CE and Western Europe, from April 2011 through March 2016. ]. This total included 316 auto suppliers, the large majority of these being transplants from Germany, France, America, and more recently, South Korea. Among these, 242 were located within the Bratislava-Zilina Corridor extended, which included neighboring the Nitra and Banska Bystrica Regions [42SARIO. Regional analyses, 2007-2014. Slovak Investment and Trade Development Agency 2008-2015. Annually revised e-documents on the automotive sector published between 2007 and 2015. [Retrieved July 21, 2015]. Available from: http://www.sario.sk/?regional-analysis , 49SARIO. Automotive industry, 2010-2014. Slovak Investment and Trade Development Agency 2011-2015. Data obtained from this annually updated e-document, retrieved on various dates between 2010 and 2015, [Retrieved July 21, 2015]. Available from: http://www.sario.sk/sites/ default/files/content/files/Automotive%20Industry.pdf , 57Jacobs, A. J. Auto FDI in emerging Europe: Shifting production locales in the world auto industry. London: Palgrave, forthcoming. Based upon the author’s: site visits and/or factory tours of VW Bratislava, VW Martin, PSA Trnava, Kia Zilina, and Audi Gyor; and correspondences with government officials, automakers, and scholarly experts in the CE and Western Europe, from April 2011 through March 2016. ], (Fig. 1 ). Moreover, in 2013, the nation produced 906,303 cars and light passenger trucks (i.e., vans, SUV/CUV, and MPV, see Tables 1, 2). According to OICA [48OICA. World motor vehicle production by country and type: 1999-2014. Paris: International Organization of Motor Vehicle Manufacturers 1999-2015. Production and sales statistics for all years between 1999 and 2014. Retrieved on various dates, last July 23, 2015. Available from: http://oica.net VW’s output in 2013 would have been 426,313 and Slovakia’s total 988,882 if the Porsche Cayenne SUV bodies built in Bratislava were counted as light vehicles. SARIO [57] counted these in its total and report national production as 987,718 in 2013, see pp, 2, 4], this constituted an increase of 631,166 or 213.67% from 2000; Ward’s World Motor Vehicle Yearbook [52Ward’s Communications. Ward’s world’s vehicle data 2014. Southfield, MI: Ward’s 2014.] placed this expansion at 745,224 or 410.97%. In both cases, Slovakia’s 2013 output represented a 160-fold enlargement from the 5,732 vehicles assembled in the country in 1993, including just 2,958 cars [48OICA. World motor vehicle production by country and type: 1999-2014. Paris: International Organization of Motor Vehicle Manufacturers 1999-2015. Production and sales statistics for all years between 1999 and 2014. Retrieved on various dates, last July 23, 2015. Available from: http://oica.net VW’s output in 2013 would have been 426,313 and Slovakia’s total 988,882 if the Porsche Cayenne SUV bodies built in Bratislava were counted as light vehicles. SARIO [57] counted these in its total and report national production as 987,718 in 2013, see pp, 2, 4, 52Ward’s Communications. Ward’s world’s vehicle data 2014. Southfield, MI: Ward’s 2014.].

). Moreover, in 2013, the nation produced 906,303 cars and light passenger trucks (i.e., vans, SUV/CUV, and MPV, see Tables 1, 2). According to OICA [48OICA. World motor vehicle production by country and type: 1999-2014. Paris: International Organization of Motor Vehicle Manufacturers 1999-2015. Production and sales statistics for all years between 1999 and 2014. Retrieved on various dates, last July 23, 2015. Available from: http://oica.net VW’s output in 2013 would have been 426,313 and Slovakia’s total 988,882 if the Porsche Cayenne SUV bodies built in Bratislava were counted as light vehicles. SARIO [57] counted these in its total and report national production as 987,718 in 2013, see pp, 2, 4], this constituted an increase of 631,166 or 213.67% from 2000; Ward’s World Motor Vehicle Yearbook [52Ward’s Communications. Ward’s world’s vehicle data 2014. Southfield, MI: Ward’s 2014.] placed this expansion at 745,224 or 410.97%. In both cases, Slovakia’s 2013 output represented a 160-fold enlargement from the 5,732 vehicles assembled in the country in 1993, including just 2,958 cars [48OICA. World motor vehicle production by country and type: 1999-2014. Paris: International Organization of Motor Vehicle Manufacturers 1999-2015. Production and sales statistics for all years between 1999 and 2014. Retrieved on various dates, last July 23, 2015. Available from: http://oica.net VW’s output in 2013 would have been 426,313 and Slovakia’s total 988,882 if the Porsche Cayenne SUV bodies built in Bratislava were counted as light vehicles. SARIO [57] counted these in its total and report national production as 987,718 in 2013, see pp, 2, 4, 52Ward’s Communications. Ward’s world’s vehicle data 2014. Southfield, MI: Ward’s 2014.].

Overall, Slovakia was Europe’s seventh largest auto producing nation in 2013 [48OICA. World motor vehicle production by country and type: 1999-2014. Paris: International Organization of Motor Vehicle Manufacturers 1999-2015. Production and sales statistics for all years between 1999 and 2014. Retrieved on various dates, last July 23, 2015. Available from: http://oica.net VW’s output in 2013 would have been 426,313 and Slovakia’s total 988,882 if the Porsche Cayenne SUV bodies built in Bratislava were counted as light vehicles. SARIO [57] counted these in its total and report national production as 987,718 in 2013, see pp, 2, 4]. More impressively, as shown in Table 2, at 167.36 vehicles per 1,000 in population in that year, Slovakia ranked first worldwide in vehicles produced per capita; it was followed by Czechia and South Korea. No other CE nation besides Czechia and Slovenia produced more than 23 automobiles per 1,000 people. As shown in Table 3, per capita production was 368.60 in the Bratislava-Zilina Corridor, and area which contained 45.40% (or 2.46 million people) of its nation’s population in 2013, but which produced 100.00% of its light vehicles.

In addition, VW’s presence in Bratislava has served as a catalyst for economic growth not only in Slovakia, but also in nearby city-regions in Hungary and Czechia [27Pavlinek P. A successful transformation? Restructuring of the Czech automobile industry. Omaha: Physica-Verlag 2008.]. This materialized in December 1993, when VW began building engines in a plant just 49 miles (78 km) south of the VW Bratislava in Gyor, a city situated in northwest Hungary’s Gyor-Moson-Sopron County (Again, see Fig. 2 ). As displayed in Table 1, the facility now known as Audi Hungaria, began manufacturing cars (sporty Audi TT) in April 1998. This was followed in November 2007 by the assembling of approximately 200 Audi A3 convertibles (cabriolet) in November 2007 [58Audi AG. Audi: 2014 annual report. Ingolstadt, Germany: Audi Group 2015., 59Audi AG. Audi Hungaria Motor Kft. [Retrieved July 15, 2015]. Available from: http://audi.hu/en ].

). As displayed in Table 1, the facility now known as Audi Hungaria, began manufacturing cars (sporty Audi TT) in April 1998. This was followed in November 2007 by the assembling of approximately 200 Audi A3 convertibles (cabriolet) in November 2007 [58Audi AG. Audi: 2014 annual report. Ingolstadt, Germany: Audi Group 2015., 59Audi AG. Audi Hungaria Motor Kft. [Retrieved July 15, 2015]. Available from: http://audi.hu/en ].

In 2013, VW completed another major expansion in Gyor, investing €900 million ($1.2 billion) and transforming its Hungarian operations into a full-fledged assembly plant. In the process, the automaker raised its total employment at the site from 6,138 in 2009 to more than 9,000 on June 12, 2013, upon the commencement of production of Audi’s brand-new A3 sedan model. Meanwhile, annual vehicle production capacity in Gyor jumped from 55,000 in 2009 to 125,000, with the plant building 42,851 cars in 2013. This total jumped to 135,272 in 2014, when the factory also manufactured 1.97 million engines and employed 11,000 workers [59Audi AG. Audi Hungaria Motor Kft. [Retrieved July 15, 2015]. Available from: http://audi.hu/en ]. In total, VW has invested more than €5.7 billion ($7.5 billion) in the complex and has long-term plans that will ultimately raise plant vehicle output to 340,000 by 2018 [59Audi AG. Audi Hungaria Motor Kft. [Retrieved July 15, 2015]. Available from: http://audi.hu/en , 60Reuters. Audi may expand Hungary plant further from 2018. January, 26. 2011. [Retrieved June 30, 2013]. Available from: http://autonews.gasgoo.com/global-news/audi-may-expand-hungary-plant-further-from-2018-110126.shtml ].

Finally, as a result of its success in Zilina, in September 2005, Hyundai Motor announced that it would produce its own brand-named subcompact cars at a newly constructed, second CE assembly plant, situated just 53 miles (85 km) west of Zilina in the Village of Nosovice, within the Frydek-Mistek District of northeastern Czechia’s Ostrava Metropolitan Area (Again, see Fig. 2 ). The first vehicles at the so-named Hyundai Nosovice Plant began rolled off the assembly line on November 3, 2008. The factory, which built 303,460 subcompacts and MPV in 2013, employed 3,300 workers and had a typical annual capacity of 300,000 vehicles [61Hyundai Motors. Hyundai motor manufacturing Czech. General Information. Nosovice, CZ. [Retrieved June 15, 2015]. Available from: http://www.hyundai-motor.cz/english.php This included Hyundai ix20 and i30 (known as Elantra elsewhere), twins of the Kia Venga and Cee’d, respectively.], (Table 1).

). The first vehicles at the so-named Hyundai Nosovice Plant began rolled off the assembly line on November 3, 2008. The factory, which built 303,460 subcompacts and MPV in 2013, employed 3,300 workers and had a typical annual capacity of 300,000 vehicles [61Hyundai Motors. Hyundai motor manufacturing Czech. General Information. Nosovice, CZ. [Retrieved June 15, 2015]. Available from: http://www.hyundai-motor.cz/english.php This included Hyundai ix20 and i30 (known as Elantra elsewhere), twins of the Kia Venga and Cee’d, respectively.], (Table 1).

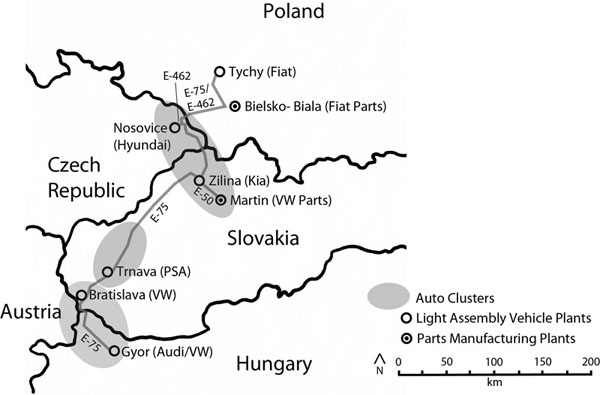

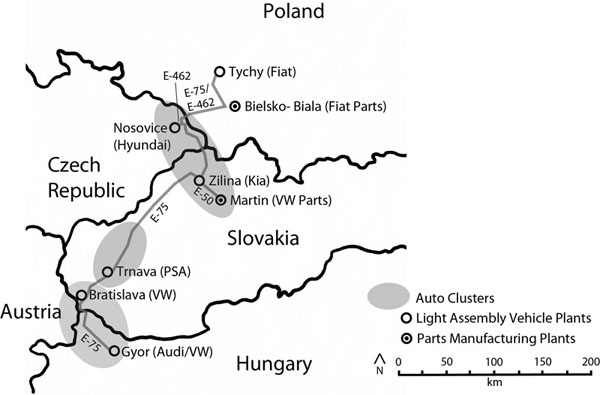

The net result of these investments has been the development of what may be called the Bratislava-Gyor-Zilina-Ostrava Auto Production Zone, an area traversing parts of three nations (western and central Slovakia, eastern Czechia, and northwestern Hungary), with a nucleus of Bratislava, and a spine running along designated European Highway 75 or E-75 (See Fig. 3 ). Within this automotive production region’s three interconnected auto clusters - VW Bratislava-Audi Gyor; PSA Trnava; and Kia Zilina-Hyundai Nosovice- there were five foreign light vehicles assembly plants, employing 30,300 workers and with production capacity of 1,425,000 vehicles annually. These facilities also helped to spur the creation of approximately 100,000 automotive supplier jobs in the extended area [57Jacobs, A. J. Auto FDI in emerging Europe: Shifting production locales in the world auto industry. London: Palgrave, forthcoming. Based upon the author’s: site visits and/or factory tours of VW Bratislava, VW Martin, PSA Trnava, Kia Zilina, and Audi Gyor; and correspondences with government officials, automakers, and scholarly experts in the CE and Western Europe, from April 2011 through March 2016. ].

). Within this automotive production region’s three interconnected auto clusters - VW Bratislava-Audi Gyor; PSA Trnava; and Kia Zilina-Hyundai Nosovice- there were five foreign light vehicles assembly plants, employing 30,300 workers and with production capacity of 1,425,000 vehicles annually. These facilities also helped to spur the creation of approximately 100,000 automotive supplier jobs in the extended area [57Jacobs, A. J. Auto FDI in emerging Europe: Shifting production locales in the world auto industry. London: Palgrave, forthcoming. Based upon the author’s: site visits and/or factory tours of VW Bratislava, VW Martin, PSA Trnava, Kia Zilina, and Audi Gyor; and correspondences with government officials, automakers, and scholarly experts in the CE and Western Europe, from April 2011 through March 2016. ].

|

Fig. (3) The Bratislava-Zilina auto corridor and other assembly plants in the CE context. |

The development of the Slovaka’s Bratislava-Zilina Corridor into a manufacturing hub for some of the world’s largest foreign automakers has been a prime example of how FDI has driven economic growth within certain post-Socialist nations. The related acceptance of Slovakia into the EU and the European Monetary Union (the Euro) suggest that its national economy has benefitted greatly from the presence of foreign automakers. On the other hand, has FDI transformed Slovakia into a semi-periphery nation situated between the core and periphery within the globe’s industrial division of labor? Or, have these developments merely made the long-term economic well-being of its largest city-regions and its nation, too overly dependent on the highly cyclical and mobile auto industry? The next sections will explore this question.

Slovak Economy, Semi-Periphery or Upper Perimeter of the Periphery?

Wallerstein’s initial early 1970s categorizations of semi-periphery nations included “a wide range of [diverse] countries in terms of economic strength and political background,” such as Brazil, Finland, South Africa, South Korea, and much of Eastern Europe. He claimed that these former periphery nations had taken various paths towards their advancement within the world economic hierarchy. In addition, he suggested that the most successful of these nations were those that had risen to semi-periphery status through import-substitution; that is, they manufactured products that they had formerly imported from core countries. On the other hand, others had enlarged their economies by producing goods no longer desired in core countries. Still, others advanced when profit-seeking producers within core nations shifted their manufacturing location to their lower wage nations.

Related to the last point he stated:

When core producers face a situation of over-supply, they begin to compete intensely with each other to maintain their share in a comparatively shrinking world market for their finished goods (especially machinery). At this time, semiperipheral nation can, up to a point, pick and choose among core producers not only in terms of sale of their commodities (viz. OPEC oil) but also in terms of welcoming their investment in manufactures… [7Wallerstein I. The capitalist world-economy: Essays by Immanuel Wallerstein. New York: Cambridge University Press 1979.].

On the surface, the latter quote seems to describe the current over-supply of production in core nations and Slovak government’s selection of VW over five other suitors to acquire BAZ Yet, did the Slovak Government really pick VW or did VW actually select Bratislava for its lower wage, but relatively skilled labor force as a site to produce cars for export to the core? After all, the German automaker tendered the highest bid for the near-bankrupt BAZ only after acquiring its former parent, Skoda, whose main plant was located in Mlada Boleslav in north-central Czechia, just 205 miles (331 km) northwest of BAZ Bratislava. In reality, the integration of BAZ facility enabled VW’s to create process and production scale synergies with its core, export-oriented Czech operations [37Jakubiak M, Kolesar P, Izvorski I, Kurekova L. The automotive industry in the Slovak Republic. Washington, DC: International Bank for Reconstruction and Development/World Bank, Commission on Growth and Development 2008. Working Paper No, 29, 41Pavlinek P. Restructuring the Central and Eastern European automobile industry: Legacies, trends, and effects of foreign direct investment. Post Sov Geogr Econ 2002; 43(1): 41-77., 50Pavlinek P, Smith A. Internationalization and embeddedness in East-Central European transition: The contrasting geographies of inward investment in the Czech and Slovak Republics. Reg Stud 1998; 32(7): 619-38.

[http://dx.doi.org/10.1080/00343409850119517] , 57Jacobs, A. J. Auto FDI in emerging Europe: Shifting production locales in the world auto industry. London: Palgrave, forthcoming. Based upon the author’s: site visits and/or factory tours of VW Bratislava, VW Martin, PSA Trnava, Kia Zilina, and Audi Gyor; and correspondences with government officials, automakers, and scholarly experts in the CE and Western Europe, from April 2011 through March 2016. , 62Smith A, Ferencíkova S. Inward investment, regional transformations, and uneven development in East-Central Europe: Case studies from Slovakia. Eur Urban Reg Stud 1998; 5(2): 155-73.

[http://dx.doi.org/10.1177/096977649800500204] , 63Pavlinek P. Transformation of the Central and East European passenger car industry: selective peripheral integration through foreign direct investment. Environ Plann A 2002; 34(9): 1685-709.

[http://dx.doi.org/10.1068/a34263] ].

As to whether or not the nascent, post-Socialist Slovakia of 1993 was a semi-periphery nation capable of picking and choosing which industries and FDI it accepted - the answer is, probably ‘not.’ Moreover, what seems more relevant is whether or not VW’s presence in Bratislava, along with that of PSA in Trnava and Kia near Zilina, actually has advanced the Slovakia’s economy position in the globe’s industrial division of labor from periphery to semi-periphery in 2015. With respect to the latter, and drawing upon definitions of semi-periphery, this is highly debatable.

Slovak Economy, Core and Peripheral Forms of Organization?

According to Chase-Dunn & Hall [3Chase-Dunn C, Hall T. Rise and demise: Comparing world Systems. Boulder: Westview Press 1997.], Wallerstein’s conceptualizations of the semi-periphery included five types of nations, those: “1) … [That] mixed both core and peripheral forms of organization; 2) … [that were] spatially located between core and peripheral nations; 3)… [that were] spatially located between two or more competing core regions; 4) … in which mediating activities linking core and peripheral areas take place; and 5) … which had institutional features [that were] intermediate in form between those forms in adjacent core and peripheral areas.” [7Wallerstein I. The capitalist world-economy: Essays by Immanuel Wallerstein. New York: Cambridge University Press 1979.]. A review of these five variations suggests that Slovakia only classifies as a semi-periphery nation based upon the most superficial criteria of the five.

In reference to Wallerstein/Chase-Dunn & Hall’s first type of semi-periphery nation, does Slovakia have both core and peripheral forms of organization? Superficially, the answer to this is yes. However, essentially all of Slovakia’s core-like industrial organizations were owned/ controlled by foreign TNCs, particularly major automakers and suppliers based in Western Europe, North America, and developed East Asia. According to the Slovak Investment and Trade Agency or SARIO, approximately 17 percent of all employment in Slovakia in 2012 (or 81,682) was directly employed in the motor vehicle industry, with more than three-quarters of this working for foreign firms. Thousands more Slovaks had indirect jobs servicing these auto plants and their workers. Moreover, nearly one-third of the value of all industrial production nation-wide and 30 percent of the value of all exports were derived from the auto sector in that year [49SARIO. Automotive industry, 2010-2014. Slovak Investment and Trade Development Agency 2011-2015. Data obtained from this annually updated e-document, retrieved on various dates between 2010 and 2015, [Retrieved July 21, 2015]. Available from: http://www.sario.sk/sites/ default/files/content/files/Automotive%20Industry.pdf , 57Jacobs, A. J. Auto FDI in emerging Europe: Shifting production locales in the world auto industry. London: Palgrave, forthcoming. Based upon the author’s: site visits and/or factory tours of VW Bratislava, VW Martin, PSA Trnava, Kia Zilina, and Audi Gyor; and correspondences with government officials, automakers, and scholarly experts in the CE and Western Europe, from April 2011 through March 2016. ].

Next, despite its plethora of foreign TNCs in manufacturing, Slovakia’s average monthly wage of €805 ($1,064) in 2012, ranked it third among four V4 nations of CE, trailing Czechia’s €998 ($1,316); Poland’s €842 ($1,113), but ahead of Hungary’s €771 ($1,019) [65Slovak Republic. Data and social statistics. Statistical Office of the Slovak Republic, Slovstat Database, 2015. [Retrieved June 15, 2015]. Available from: http://slovak.statistics.sk/ ]. In addition, Slovakia’s national average wage has continued to be very unevenly distributed, inflated by its capital city region of Bratislava. As shown in Table 4 for the more recently available 2013, the national average monthly wage of €891 ($1,177) was significantly lower than that of the Bratislava City-region, whose residents secured an average monthly wage of €1,182 ($1,627) in 2013. In fact, this disparity has remained fairly constant since 2001.

As also presented in Table 4, whereas the capital area’s monthly wages expanded by €599 ($825) or 102.74% between 2001 and 2013, the national average increased by just €448 ($617) and 101.07%. In other words, whereas annual wages in Bratislava increased by €7,188 ($9,900) from €6,996 ($9,900) to €14,184 ($19,524) between 2001 and 2013, the national annual wage grew by only €5,376 ($9,900) from €5,316 ($7,317) to €10,692 ($14,717) during this period. Meanwhile, despite hosting major foreign automotive assembly plants and/or Tier-I suppliers, the city-regions of Trnava (€10,092 or $13,891), Zilina (€9,840 or $13,545), and Trencin (€9,708 or $13,363) all continued to have annual and wages below the national average. The situation was even more uneven between Bratislava and other regions of Slovakia [66Slovak Republic. Earnings of employees by NACE Rev. 2: Average monthly wages. Statistical Office of the Slovak Republic, STATdat, 2015. Public Data Base. [Retrieved June 15, 2015]. Available from: http://statdat.statistics.sk/ , 67Pavlinek P. Regional development implications of foreign direct investment in Central Europe. Eur Urban Reg Stud 2004; 11(1): 47-70.

[http://dx.doi.org/10.1177/0969776404039142] ]. Lastly and as previously mentioned, in large part because of the Bratislava assembly plant, more than two-thirds of all FDI coming into Slovakia since 2002 has been spent in the Bratislava Region. Moreover, this proportion has risen over time, growing from between 55.9% and 62.5% during the 1995 to 2001 period.

In summary words, as Pavlinek [19Pavlinek P, Domanski B, Guzik R. Industrial upgrading through foreign direct investment in central European automotive manufacturing. Eur Urban Reg Stud 2009; 16(1): 43-63.

[http://dx.doi.org/10.1177/0969776408098932] , 32Pavlinek P, Zenka J. The 2008-2009 automotive industry crisis and regional unemployment in Central Europe. Camb J Regions Econ Soc 2010; 3(3): 349-65.

[http://dx.doi.org/10.1093/cjres/rsq026] , 41Pavlinek P. Restructuring the Central and Eastern European automobile industry: Legacies, trends, and effects of foreign direct investment. Post Sov Geogr Econ 2002; 43(1): 41-77., 68Moving Progress VW. Volkswagen AG Annual Report 2014. Wolfsburg: VW Group Communications 2015.] and his collaborators claimed, although Slovakia may have become a middle income nation with semi-periphery-like GDP and wages, its widening uneven development and over-dependence on export-oriented, TNC-based Auto FDI, which has made it extremely vulnerable to global economic cycles, suggested that its organizational forms were more periphery-like than semi-peripheral. In sum, Slovakia really does not qualify as a semi-periphery nation under category one of Wallerstein/Chase-Dunn & Hall’s typology.

Slovakia is Located But Not Linked Between Core and Peripheral, Nor Competing Core Nations

In reference to Wallerstein/Chase-Dunn & Hall’s second, third, and fourth categories/types of semi-periphery nations, Slovakia, located between Austria (and indirectly Germany) and emerging Eastern Europe, similar to its CE neighbor, was spatially situated between Europe’s core and periphery nations. Moreover, this was one of the primary factors attracting major automakers to the Bratislava-Zilina Corridor.

On the other hand, without any core nations to its east, the vast majority of Slovak automotive exports were exported Western nations. Bratislava was currently the only plant worldwide manufacturing VW Touareg and one of only two that were building Audi Q7 (the other was in India). Therefore, it could be argued that since these two VW luxury SUV models were bound for the U.S. and Canada, Slovakia has mediated activities between Germany and two other core nations, the U.S. and Canada.

Nevertheless, only a combined 28,079 Audi Q7 and VW Touareg were sold in the U.S. and Canada in 2013. In comparison a total of 134,404 of these vehicles were built in Bratislava in the same year [51Ward’s Communications. Ward’s automotive yearbook, 2014. Southfield, MI: Ward’s 2014., 52Ward’s Communications. Ward’s world’s vehicle data 2014. Southfield, MI: Ward’s 2014., 69Jacobs AJ. The ‘new domestic’ automakers and motor vehicle-related FDI in the U.S. and Canada: History, Impacts, and Prospects. Lanham, MD: Lexington Books 2015. PSA withdrew from the North American market in 1991 with the last Canadian and U.S. dealer deliveries of the Peugeot 405 compact sedan/wagon and the Peugeot 505 mid-size sedan/wagon occurring in March and July 1992, respectively. In: ]. Moreover, all of the Hyundai-Kia light vehicles that were sold in the two countries in 2013 were produced in either the U.S or South Korea, and the last vehicles delivered by PSA in the two North American nations was in 1992 [70For Kia, 99% of the vehicles manufactured at Kia Zilina in 2013 and 99.1% of their total value, were exported out of the country. For PSA Trnava, these figures were 99% and 96.0%, respectively [see 49]. ]. Consequently, Slovakia does not seem to fit within Wallerstein/Chase-Dunn & Hall’s third type of semi-periphery nation.

Similarly, since nearly all of its automotive parts were domestically manufactured, or built in Germany, France, or South Korea, Slovakia was not a region in which its mediating activities truly linked core and peripheral areas. Its plants primarily served as a periphery-like export base for TNCs seeking to cut production costs by assembling their finished goods in a lower wage area and then by shipping outputs back to core countries in Western Europe. In other words, Slovakia’s manufacturing activities did not seem to suggest that it qualifies as a semi-periphery nation within Wallerstein/Chase-Dunn & Hall’s fourth category.

Slovakia’s Institutional Features/Firms are More Peripheral than Intermediate

Finally, Slovakia’s institutional features, at least in industrial organizations, do not seem fit within Wallerstein/Chase-Dunn & Hall’s fifth type of semi-periphery nations, as they appear more peripheral-like than intermediate-like. For example, unlike Evans’ [38Evans P. Class, state and dependence in East Asia: Lessons for Latin Americanists. In: Deyo F, Ed. The political economy of the new Asian industrialism. Ithaca, NY: Cornell University Press 1987; pp. 203-26.] descriptions of East Asia’s Newly Industrializing Economies (NIEs) in the 1980s (particularly South Korea), or today’s largest semi-periphery nations, China, India, and Russa, Slovakia has no native-owned or operated motor vehicle producers. With the exception of a handful of Tier-II suppliers, the same held true for its automotive supply base, and for that matter, for most of its other industrial sectors.

Next, Slovakia has essentially failed to launch a credible import-substitution campaign in the automotive sector. Well over half of the parts installed in vehicles finished in Slovakia still were imported from core nations. Additionally, total new cars sales in the country have represented only a tiny percentage of production, and the vast majority of vehicles sold, either new or used, have been imports.

More specifically, automakers produced 906,393 complete passenger vehicles in Slovakia’s Bratislava-Zilina Corridor in 2013. One hundred percent of these vehicles were built by foreign automakers. In addition, of the 4.34 million vehicles manufactured in the nation between 2007 and 2013, nearly all (99 percent), were exported out of the country. Meanwhile, only 589,355 new cars were sold in Slovakia during this six-year period, or equivalent to 13.59% of total production [48OICA. World motor vehicle production by country and type: 1999-2014. Paris: International Organization of Motor Vehicle Manufacturers 1999-2015. Production and sales statistics for all years between 1999 and 2014. Retrieved on various dates, last July 23, 2015. Available from: http://oica.net VW’s output in 2013 would have been 426,313 and Slovakia’s total 988,882 if the Porsche Cayenne SUV bodies built in Bratislava were counted as light vehicles. SARIO [57] counted these in its total and report national production as 987,718 in 2013, see pp, 2, 4, 49SARIO. Automotive industry, 2010-2014. Slovak Investment and Trade Development Agency 2011-2015. Data obtained from this annually updated e-document, retrieved on various dates between 2010 and 2015, [Retrieved July 21, 2015]. Available from: http://www.sario.sk/sites/ default/files/content/files/Automotive%20Industry.pdf , 52Ward’s Communications. Ward’s world’s vehicle data 2014. Southfield, MI: Ward’s 2014.]. However, the latter figure was misleading, as it represented all new car sales, irrespective of manufacturer.

For example, when comparing sales and production figures for 2013 of only the brands sold in Slovakia by the three automakers manufacturing cars in that nation- VW (VW, Audi, Porsche, SEAT, and Skoda), Hyundai-Kia, and Peugeot-Citroen- the contrast becomes even more startling. As compared with the 906,303 light vehicles built by the three vehicle companies in Slovakia in 2013, only 41,947 new cars and light trucks were sold under these brands in the nation in that year, or a mere 4.63% of production; the latter figure also included light commercial vehicles. This percentage of sales to output has actually backtracked over time, despite the fact that vehicle production expanded by 378,140 or 71.60% between 2007 and 2013. In the interim, sales of these brands declined by 17,753 nation-wide or by 29.74%, from 59,700 in 2007 to 41,659 in 2013.

The foremost example of this unequal relationship was VW, which between 2008 and 2011 primarily built luxury SUV (Audi Q7 and VW Touareg) in Bratislava for export to Western Europe and America. According to the Slovak Government, 99% of the vehicles manufactured at VW’s Bratislava Plant in 2013, and 99.8% of their total value, were exported out of the country; the value figure included the Porsche Cayenne SUV bodies bent at the factory and bound for VW’s Porsche final assembly plant in Leipzig, Germany. These figures were 99% and 99.0%, respectively, for all light vehicles produced in Slovakia in 2013 [42SARIO. Regional analyses, 2007-2014. Slovak Investment and Trade Development Agency 2008-2015. Annually revised e-documents on the automotive sector published between 2007 and 2015. [Retrieved July 21, 2015]. Available from: http://www.sario.sk/?regional-analysis , 49SARIO. Automotive industry, 2010-2014. Slovak Investment and Trade Development Agency 2011-2015. Data obtained from this annually updated e-document, retrieved on various dates between 2010 and 2015, [Retrieved July 21, 2015]. Available from: http://www.sario.sk/sites/ default/files/content/files/Automotive%20Industry.pdf ]

In Audi’s case, it sold only 1,427 vehicles in Slovakia in 2013, irrespective of model, or the equivalent of only 2.25% of 63,543 vehicles VW produced under that marque in Slovakia in that year. In other words, only a very small segment of the approximately 82,000 workers employed in the automotive sector in Slovakia, or citizens of the country itself for that matter, had the financial wherewithal to buy the VW vehicles built in Bratislava. The same was the case for Audi Hungaria in Gyor, where Audi A3 convertibles (cabriolet), RS3, and TT Coupe and Roadsters were assembled.

VW’s Tier-I and Tier-II suppliers in Slovakia followed a similar strategy. As mentioned earlier, 93 percent of the gearboxes, chassis components, and other parts manufactured at VW Martin were exported out of the country. More than two-thirds of Martin’s production was bound for VW’s massive Kassel, Germany transmission and components complex [45VW AG. Volkswagen Slovakia. Retrieved on various dates, [Retrieved June 15, 2015]. Available from: http://en.volkswagen.sk/en/Company/ plants.html , 47Volkswagen VW. Facts and figures, Navigator 2013. Wolfsburg: VW Group 2013., 49SARIO. Automotive industry, 2010-2014. Slovak Investment and Trade Development Agency 2011-2015. Data obtained from this annually updated e-document, retrieved on various dates between 2010 and 2015, [Retrieved July 21, 2015]. Available from: http://www.sario.sk/sites/ default/files/content/files/Automotive%20Industry.pdf ]. Most of the other parts fabricated, such as INA (bearings) and Continental Tires, both of Germany, exported more than half of their output. Similarly, only 5.53% of the 1.93 million engines built at VW’s Audi plant in Gyor in 2013`were installed in Hungarian or Slovak-made Audi vehicles. Conversely, the Gyor factory supplied approximately 1.6 million motors to Audi and VW vehicles built in Germany and Belgium, such as its popular A6, built in Neckarsulm, and A4, manufactured in Neckarsulm for the American market and at Audi’s main plant in Ingolstadt for Europe [57Jacobs, A. J. Auto FDI in emerging Europe: Shifting production locales in the world auto industry. London: Palgrave, forthcoming. Based upon the author’s: site visits and/or factory tours of VW Bratislava, VW Martin, PSA Trnava, Kia Zilina, and Audi Gyor; and correspondences with government officials, automakers, and scholarly experts in the CE and Western Europe, from April 2011 through March 2016. , 58Audi AG. Audi: 2014 annual report. Ingolstadt, Germany: Audi Group 2015.]. Moreover, well over half of the parts installed in Bratislava vehicles were assembled outside of Slovakia [19Pavlinek P, Domanski B, Guzik R. Industrial upgrading through foreign direct investment in central European automotive manufacturing. Eur Urban Reg Stud 2009; 16(1): 43-63.

[http://dx.doi.org/10.1177/0969776408098932] ].

Related to this, among the 40 largest automotive suppliers in Slovakia, 29 were located within the four-city-regions in the Bratislava-Zilina Corridor. All 29 were foreign-owned, including 13 with 1,000 or more employees in 2013. With only a handful of domestic-owned firms even participating in the auto industry production chain, very little technology transfer has occurred between TNCs and native firms. In addition, Research & Development expenditures in the area have been minimal, with almost all of these operations remained in the core-nations of foreign automakers, particularly, Germany, France, South Korea, and the USA [28Pavlinek P. The internationalization of corporate R&D and the automotive industry R&D of East-Central Europe. Econ Geogr 2012; 88(3): 279-310.

[http://dx.doi.org/10.1111/j.1944-8287.2012.01155.x] , 71Lane D. Postsocialist states in the system of global capitalism: A comparative perspective. In: Boschi R, Santana C, Eds. Development and Semi-periphery: Post-neoliberal trajectories in South America and Central Eastern Europe. London: Anthem 2012; pp. 19-43.

[http://dx.doi.org/10.7135/UPO9780857286536.002] , 72Knox P, Agnew J, McCarthy L. The geography of the world economy. 6 ed. New York: Routledge, 2014.].